XY Growth

Fund

Strategic global investors, who share XY Vision.

Investors ensure that startups build for scale & can grow with right network.

StartupXY brings,

Multi million $ Tech fund.

"Create, Boot-Strap, Fund, Scale, Repeat"

Whom we..

seek,

Rebels & Firstfits

Who, have an innate drive to be positive change agents @ Impact globally.

Fund Criteria

What is Must

Min Revenue eligibility - $100k+ PA.

High Impact Founding Team.

Industry Agnostic: SaaS or Social Enterprise.

Solving for a major problem.

Having an Unfair Moat.

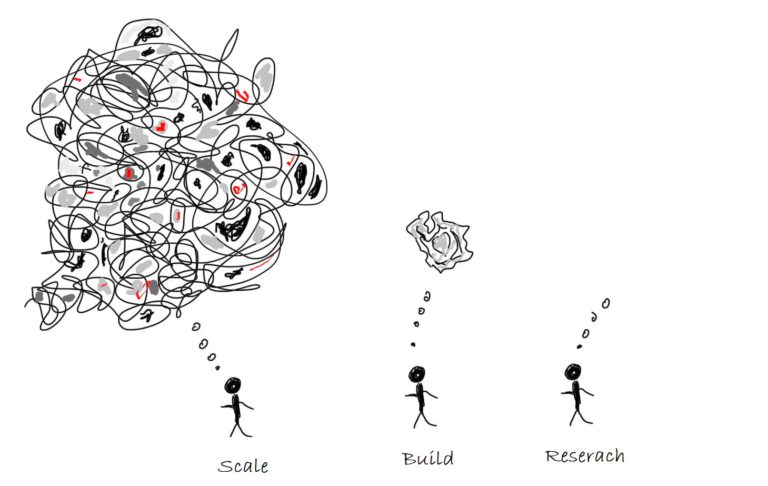

100X Scale, 10X Impact, 10X Returns.

Ability to demonstrate agility & scale.

Scale Now

Funding Process

1. Startup Intro

Share your Pitch Deck

Call/Meeting for Elevator Pitch.

Deep Dive session

Post Call: Share Trends, GTM, Financial Actuals.

Qtr and 2 Yr Projections

Capitalization Table

Funding Amount & Allocation plan

2. Ref & Checks

Ref Checks with Customers

Ref Checks with Advisors & Stake holders.

Feedback On Team & Product.

Connect to Paneled Investors for perspective

Physical Office Visit for Product Demo & Meet Team.

3. Term Sheets

Discuss - SAFE, Equity or Debt options

Startup Drafts the 1st term-sheet.

Feedback & Negotiation

Final Term Sheets.

Legal & Accounting Compliance

Final meetings with Investor.

Fund disbursement process started

3. Term Sheets

Discuss - SAFE, Equity or Debt options

Startup Drafts the 1st term-sheet.

Feedback & Negotiation

Final Term Sheets.

Legal & Accounting Compliance

Final meetings with Investor.

Fund disbursement process started

4. Shareholder Agreement

Sign a Term Sheet.

Hire a lawyer to draft Shareholder agreement.

Get ROC filings to process investment.

Ensure Board Meeting passes the share-holder agreement.

Execute Shareholder agreement.

4. Shareholder Agreement

Sign a Term Sheet.

Hire a lawyer to draft Shareholder agreement.

Get ROC filings to process investment.

Ensure Board Meeting passes the share-holder agreement.

Execute Shareholder agreement.

5. Fillings & Allotment

Issue PAS-4 offer letter to Investors.

Issue Share Application forms.

File PAS-4 with ROC with-in 30 days.

Completion of all conditions, if in Share Agreement.

Investors notify their approval on which investors subscribe to shares.

Convene Board Meeting for issue & allotment.

Ammend AOA.

Appointment of Nominee Director

Fill Form DIR-2.

Filling of PAS3, MGT14 and DIR-12.

XY Investors,

Go beyond just funding and become your vital Strategic arm, they are your evangelists, coach, bankers who open new markets, create opportunities and up-sell your business model. We prefer Investors pair with startups in similar Network domains to amplify strategic value at speed.